BTC Price Prediction: Bull Market Targets $150K by October as Institutional Adoption Accelerates

#BTC

- Technical Strength: Price above key moving averages with improving momentum indicators

- Institutional Adoption: ETF inflows and corporate treasury movements support long-term valuation

- Regulatory Landscape: Potential government actions could create short-term volatility

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amid Market Consolidation

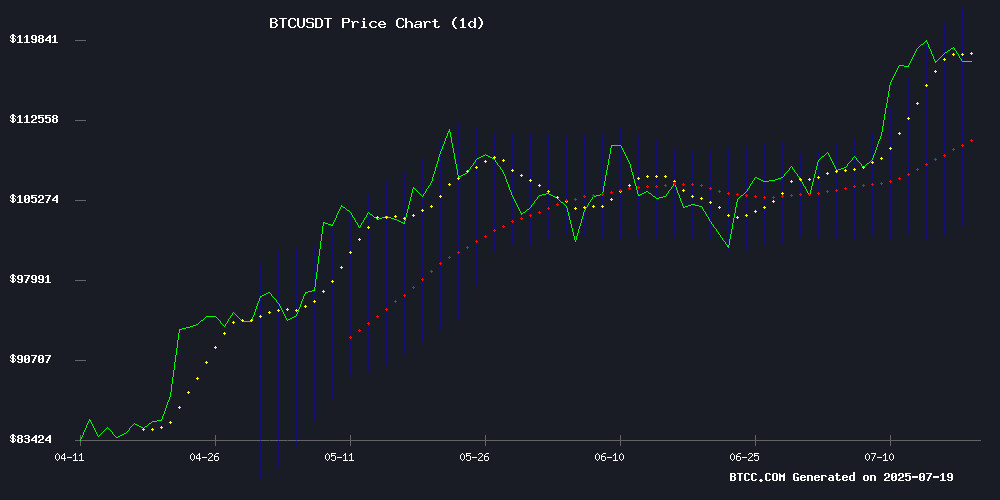

According to BTCC financial analyst Robert, BTC is currently trading at $117,825.42, above its 20-day moving average of $113,313.50, indicating a bullish trend. The MACD remains negative but shows signs of convergence, suggesting weakening downward momentum. Bollinger Bands indicate volatility, with the price NEAR the upper band, hinting at potential overbought conditions. Robert notes that a sustained break above $120,000 could trigger further upside.

Market Sentiment Mixed as Institutional Adoption Grows

BTCC's Robert highlights conflicting signals in recent news: bullish developments like Bitcoin ETF inflows and institutional adoption (Block's S&P 500 inclusion) contrast with bearish warnings (Peter Schiff's tulip mania comparison). The 90% fee reduction and UFC's crypto betting integration show growing mainstream acceptance. Robert cautions that while Cooper Research's $150K prediction aligns with technicals, investors should monitor macroeconomic factors.

Factors Influencing BTC's Price

UFC 318: Holloway vs. Poirier Trilogy and Crypto Betting Integration

Max Holloway seeks redemption against Dustin Poirier in a highly anticipated trilogy fight at UFC 318, aiming to avenge previous losses and re-enter title contention. Poirier, the interim lightweight champion, looks to cap off his career with a victory in front of his home crowd.

Despite speculation, former President Donald Trump will not attend the event, though his longstanding ties to UFC and Dana White remain a topic of interest. Trump's absence does little to dampen the excitement surrounding the bout.

The UFC's deep integration with cryptocurrency continues to shape its modern branding. A landmark 2021 deal with Crypto.com placed its logos on fighter uniforms and introduced Bitcoin bonuses for top fan-voted performances, ranging from $10K to $30K. This partnership underscores the growing synergy between combat sports and digital assets.

Prediction markets like Polymarket and Myriad offer crypto-based betting options for the event, with Holloway currently favored in both platforms. The tight odds reflect the high stakes of this legacy-defining matchup.

Bitcoin Minimum Fee Rate Slashed by 90%—Is That a Good Thing?

Bitcoin transaction fees have plummeted to a record low, with mining pools now accepting payments as minimal as 0.1 satoshi per virtual byte—a 90% reduction from the previous floor of 1 satoshi. The drastic cut reflects dwindling activity on the blockchain, as miners compete for scarce transactions to process.

The fee compression reignites Bitcoin's perennial debate: Should it function as digital gold for long-term value storage, or evolve into a medium for everyday payments? Proponents of the 'store of value' thesis argue low fees signal weak utility, while payment advocates see an opportunity for broader adoption through affordable microtransactions.

Mempool data reveals a stark decline in blockspace demand, with the network operating far below capacity. This lull follows April's halving event, which reduced miner rewards by 50%. Some analysts interpret the fee war as miners' stopgap measure to maintain revenue streams amid depressed transaction volumes and shrinking block subsidies.

Bitcoin.com Casino's 1 BTC Weekly Challenge Reaches Record Performance

Bitcoin.com Casino has launched a high-stakes weekly tournament, offering 1 BTC in prizes to top-performing gamblers. The current leaderboard shows an unprecedented score of 10,860 points, with the frontrunner positioned to claim 0.5 BTC. The competition runs weekly from Monday to Sunday UTC, rewarding the top 15 participants with a share of the prize pool.

The platform emphasizes blockchain-powered anonymity and instant payouts, aligning with its ambition to become the premier crypto gaming destination. Participants qualify by wagering on any game, with every bet contributing to their leaderboard position. This transparent reward structure reflects the casino's focus on combining cryptographic innovation with player engagement.

Bitcoin Standard Treasury Reserve (BSTR) to Go Public via SPAC Merger with Cantor Fitzgerald

Adam Back, a pivotal figure in Bitcoin's early development, is steering Bitcoin Standard Treasury Reserve (BSTR) toward a Nasdaq listing through a SPAC merger with Cantor Equity Partners I. The deal, backed by a $3.5 billion Bitcoin reserve, signals deepening institutional interest in structured crypto exposure.

BSTR's balance sheet holds 30,021 BTC, with 25,000 contributed by founding shareholders including Blockstream Capital and Back himself. The remaining 5,021 BTC were acquired through PIPE financing. Cantor Fitzgerald's involvement, led by Brandon Lutnick, underscores traditional finance's growing embrace of Bitcoin-centric investment vehicles.

The transaction positions BSTR as the fourth-largest public Bitcoin treasury, with plans to raise an additional $1.5 billion. This move follows a broader trend of institutional adoption, as public companies increasingly allocate reserves to Bitcoin as a treasury asset.

Bitcoin (BTC) Price Prediction: When and Where Will the Bull Market Peak?

Bitcoin's 4-year cycle suggests a potential bull market peak between October 2025 and December 2025. Historical patterns indicate three years of upward movement followed by a one-year correction, with the current cycle nearing its third year. Market participants are closely watching on-chain data and sentiment for clues.

The 4-year cycle has been remarkably accurate in predicting Bitcoin's price movements. Each green box in the chart represents three years of gains, while the red box marks the correction phase. The current cycle is approaching the red zone, signaling a possible topping phase.

Where Bitcoin might top this cycle remains uncertain, but historical trends and market indicators provide valuable insights. Analysts are scrutinizing key levels and institutional adoption to gauge the next major move.

Block's S&P 500 Inclusion Marks Crypto's Wall Street Ascent

Jack Dorsey's Block, formerly Square, has secured a place in the S&P 500, replacing Hess Corp. The milestone sent its shares surging nearly 9% as markets recognized the company's assertive crypto strategy. Block holds 8,584 BTC and champions Bitcoin's Lightning Network, distinguishing itself from traditional fintech players.

This follows Coinbase's recent entry into the index, solidifying cryptocurrency's foothold in mainstream finance. The move represents more than a technical adjustment—it signals trillions in passive investment flows warming to Bitcoin's infrastructure.

Dorsey's firm continues pushing crypto adoption, recently proposing to rename satoshis as 'bits' for broader appeal. As index funds absorb these assets, Wall Street's cultural resistance to decentralized finance weakens.

Bitcoin Price Prediction: Michael Saylor Forecasts $1 Million BTC by 2035 Amid Accumulation Signals

MicroStrategy Executive Chairman Michael Saylor doubled down on his ultra-bullish Bitcoin stance at the Bitcoin 2025 conference, projecting a $1 million price target by 2035. "When Wall Street is 10% Bitcoin, Bitcoin will be $1,000,000 a coin," Saylor declared, citing institutional adoption and Bitcoin's fixed supply as key drivers.

Technical analysts observe strong accumulation patterns beneath current price levels despite Bitcoin's consolidation below all-time highs. Galaxy Digital's Michael Harvey notes: "Consolidation around current prices is my base case given the large rally and new ATH." The market appears to be building foundations for its next major move.

Saylor's prediction builds on his earlier $200,000-$250,000 forecast for 2026, with passive capital inflows increasingly supporting his long-term thesis. The cryptocurrency's role as an inflation hedge continues attracting institutional interest during this accumulation phase.

Max Keiser Warns of Government Crackdown on Corporate Bitcoin Holdings

Bitcoin maximalist Max Keiser has issued a stark warning to investors utilizing Bitcoin ETFs and centralized treasuries for crypto exposure. Corporate adoption may be growing, but Keiser argues these vehicles fundamentally contradict Bitcoin's decentralized ethos. The very feature that makes them attractive to institutions—centralized custody—could make them vulnerable to state intervention.

By 2035, Bitcoin could rival Wall Street's influence, but this ascendancy won't go unchallenged. Governments protecting monetary hegemony may target ETF-held BTC, mirroring historical gold confiscations. Keiser's solution is uncompromising: self-custody or nothing. "Not your keys, not your coins" evolves from a meme to a survival strategy in this regulatory climate.

Bitcoin ETFs See Sustained Inflows Amid Market Consolidation

Bitcoin's price action shows consolidation near record highs as institutional demand continues unabated. The cryptocurrency traded at $118,200 on July 19, just below its $123,000 peak, marking a 58% recovery from 2024 lows. This stability occurs against a backdrop of six consecutive weeks of ETF inflows, with last week's $2.3 billion additions pushing total assets under management to unprecedented levels.

BlackRock's IBIT ETF now ranks as the firm's eighth-largest fund with $86 billion in assets, while Fidelity and Grayscale products hold $24 billion and $21 billion respectively. Wall Street's embrace reflects growing recognition of Bitcoin's historical outperformance versus traditional assets. Macroeconomic concerns—including US debt expansion and inflationary pressures—appear to be driving this institutional adoption.

The regulatory landscape evolved concurrently, with President Trump signing the GENIUS Act to establish stablecoin oversight frameworks. Market participants interpreted this development as removing a key uncertainty for digital asset adoption, potentially contributing to continued capital inflows.

Peter Schiff Compares Crypto Hype to Tulip Mania, Blames Trump for Dollar's Demise

Gold advocate Peter Schiff has launched a scathing critique of Bitcoin and the broader cryptocurrency market, drawing parallels to 17th-century tulip mania. The Euro Pacific Capital CEO singled out former President Donald Trump for lending legitimacy to what he calls a "decentralized Ponzi scheme."

Schiff's X post alleges Trump's pro-crypto stance accelerates dollar devaluation while creating false credibility for digital assets. "Bitcoiners may cheer dollar weakness," he wrote, "but gold will emerge victorious when both fiat and crypto collapse." The remarks come amid heated debate about recent cryptocurrency legislation.

The veteran gold bug dismissed regulatory efforts as theatrical hype cycles, accusing industry insiders of using political support to pump asset prices before exits. Schiff maintains Bitcoin lacks intrinsic value despite its growing adoption narrative, positioning gold as the ultimate safe haven during currency crises.

Bitcoin Price Poised to Rally to $150K by October, Says Cooper Research

Bitcoin could surge to $150,000 by early October, according to a Cooper Research report. Analysts cite strong inflows into spot Bitcoin ETFs as a key driver for the anticipated rally. The asset appears primed for significant upward momentum, with markets potentially overheating between $140,000 and $200,000.

Economic uncertainties are fueling demand for risk-on investments like Bitcoin. Recent consumer price data from the Bureau of Labor Statistics has heightened investor concerns about the U.S. economy, while expectations of delayed Fed rate cuts further bolster crypto's appeal.

Is BTC a good investment?

Based on current technicals and market sentiment, BTCC's Robert identifies three key considerations for BTC investors:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +3.98% above | Bullish momentum |

| MACD Histogram | -1,150.75 | Bearish but improving |

| Bollinger %B | 0.89 | Near overbought |

Robert suggests BTC presents a high-risk/high-reward opportunity, with technical targets at $123,238 (upper Bollinger) and $150,000 (analyst consensus). The SPAC merger and ETF inflows indicate growing institutional demand, though regulatory risks (Keiser's warning) remain.